Macro-prudential Policy: Implementing the Financial Stability Mandate in a Volatile Environment 2023

Macro-prudential Policy: Implementing the Financial Stability Mandate in a Volatile Environment

Macro-prudential Policy: Implementing the Financial Stability Mandate in a Volatile Environment

February 27 - March 2

Live Content sessions held: 8am–12pm (EST) | 1pm–5pm (GMT) | 9pm–1am (SGT)

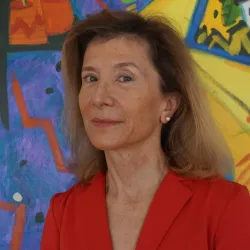

Chair: Maria Nieto, senior advisor, Bank of Spain

- How are global geopolitical risks increasing inflation worldwide and what does it mean for financial stability?

- What are the key transition and physical risks of climate change and how will it affect the stability of financial systems?

- What are the core differences between Open Finance vs. Decentralized Finance (DeFi) – and why are they important for central bankers?

Amid the highly volatile global environment, risks to financial stability have significantly increased.

Energy and commodity price shocks, amplified by the war in Ukraine and supply bottlenecks, have fueled inflation, forcing central banks to raise rates when economies are weakening.

Tighter conditions have resulted in significant market corrections. And, as yields rise, central banks are looking at their own balance sheets with concern. Some warn of impending negative capital.

All this comes at a time when central banks are studying the effectiveness of macroprudential policies and tools, and understanding the implications of Defi and Open Finance.

This course is designed to equip central bankers to meet these challenges.

Each day will feature three hours of expert-led Live Content to ensure a range of perspectives on key topics.

The course chair will ensure participants have opportunities to network throughout the course, with time set aside for a workshop on implementing recommendations, to maximise the opportunities to share and learn.

Agenda

Two weeks prior to your training course you will be emailed access to our content hub with course materials, including a trial to Central Banking if you are not already subscribed. There will be a combination of articles, reports and presentations that will contribute to two hours of preparation time for the live content. Presentations for the sessions will also be held here subject to the speaker approval.

13:00 – 13:30

Course introduction

Course introduction session led by the chair

06:00 - 06:15

- Introductions and welcome from the chairperson

- Overview of the training course

- Discussion of the delegate expectations

Maria Nieto

Advisor in the Directorate of Financial Stability, Regulation and Resolution

Bank of Spain

María J. Nieto is Associate to the Director General, Banking Regulation at Bank of Spain where she has developed different responsibilities in the realm of financial stability and its regulatory framework including crisis management since December 2000. Ms Nieto has been a contributor to the Basel Committee of Banking Supervisors as well as the European Commission, BIS, ECB and OECD. She is author of several articles on banking and regulatory issues that have been published by prestigious journals and member of the Editorial Boards of the Journal of Banking Regulation and the Journal of Financial Regulation and Compliance. She has cooperated as consultant with the IMF and the Federal Reserve Bank of Atlanta and has worked at the ECB, Council of Economic Advisors to the Spanish President, the EBRD and the IMF. Ms Nieto earned a PhD cum laude from the Universidad Complutense de Madrid and a MBA from the University of California Los Angeles.

13:30 – 14:30

Macro-prudential policies in the face of recent crises

13:30 - 14:30

-

Tips for effective coordination and calibration of macro- and micro-prudential policy

-

Examples of mechanisms for a continuous exchange of information for conflict resolution

-

Case study: macro- and micro-prudential supervision in the face of the recent crisis (Covid19, rising inflation and deterioration of the economic outlook)

John Fell

Deputy director general, macro-prudential policy and financial stability

European Central Bank

John Fell is Deputy Director General for Macroprudential Policy & Financial Stability in the ECB. He is also the chair or co-chair of several international working groups - including the Eurosystem’s Macroprudential Policy Group (MPPG), the European Systemic Risk Board’s (ESRB) Instrument Working Group (IWG), and the ESRB’s task force on stress-testing. He is a member of the ECB’s Financial Stability Committee (FSC), the ESRB’s Advisory Technical Committee (ATC), and the Financial Stability Board’s Standing Committee on Assessing Vulnerabilities (SCAV). He led the stress-testing work for the ECB’s “comprehensive assessment” in 2014 as well as EU-wide banking sector stress-tests coordinated by the Committee of European Banking Supervisors (CEBS) (2009, 2010) and the European Banking Authority (EBA) (2011, 2014). His crisis management experience is extensive, including negotiating EU/IMF financial assistance programs in several euro area countries (e.g. in Ireland, Portugal and Spain). Between 2003 and 2010, he was Head of the ECB’s Financial Stability Division, spearheading the inaugural issue of the ECB’s Financial Stability Review in 2004 and directing it thereafter. Before moving to the financial stability area in 2003, he was an Adviser in the ECB’s Monetary Policy Directorate. Prior to joining the ECB in 1998, as a principal economist, he held various positions at the European Monetary Institute (EMI) and the Central Bank of Ireland. John holds postgraduate degrees in Economics (1987) and in Finance (1993) from University College Dublin and Dublin City University respectively, and is a PhD candidate at the Rotterdam School of Management, Erasmus University. He has published his research in several academic and policy journals.

14:30 – 14:45

Break

12:45 - 13:00

14:45 – 15:45

Implications of climate change for the stability of financial systems

14:45 - 15:45

-

Overview of key transition and physical risks

-

Climate scenario analysis for central banks and supervisors:

-

Key elements of the climate risk scenario analysis for climate stress testing

Lucia Alessi is Responsible for Sustainable Finance at the Joint Research Centre of the European Commission. Her team develops research in support of EU policymaking on sustainable investments and ESG risks. Her more recent research focuses on the development of carbon stress tests and the assessment of ESG risks for banks, on the analysis of investors' attitude towards climate risk, and on the EU green Taxonomy. From 2007 to 2015 she worked at the European Central Bank, where she served in various areas, including Research, Economics, and Macroprudential Policy and Financial Stability.

15:45 – 16:15

Networking break

15:30 - 16:00

16:15 – 17:15

Financial Stability in the New High-Inflation and low Growth Environment

16:15 - 17:15

-

The policy response of central banks to high inflation and challenges for financial stability

-

What are the risks of a disorderly tightening of financial conditions

-

How do central bankers adjust to this new high inflation world, while preserving financial stability

Karsten Gerdrup

Director, macroeconometric modelling - monetary policy and financial stability

Norges Bank

Building an effective framework against systemic risk

13:00 – 14:00

Systemic stress-testing at work: tools and approaches

13:00 - 14:00

-

A practical guide to stress testing – what you need in your toolbox

-

The evolving role of systemic stress-testing in financial stability assessment: bottom-up vs top-down stress testing

-

Building blocks of an effective top-down stress testing framework

-

Avenues for post-Corona stress-testing

Jérôme Henry

Principal adviser, macroprudential policy and financial stability

European Central Bank

Jérôme Henry is the principal adviser in the European Central Bank (ECB) macroprudential policy and financial stability division. His responsibilities cover financial stability assessments and the related infrastructure requirements. Henry has led ECB teams for quality assurance of the single supervisory mechanism stress tests and was involved in country crisis management. He also worked at the Bank for International Settlements as a Financial Stability Institute fellow. Prior to this, Henry was a long-standing Eurosystem forecast co-ordinator. He started his time at the ECB leading the macromodelling team. Prior to his central bank career, Henry conducted research at the French Economic Observatory and the French National Institute of Statistics and Economic Studies. He is a founding member of the Centre for Economic Policy Research Euro Area Business Cycle Network. An Ensae Paris graduate, Henry holds a PhD in Economics and a bachelors degree in History from Paris Sorbonne.

14:00 – 14:15

Break

12:45 - 13:00

14:15 – 15:15

Basel IV – The Final Countdown

14:15 - 15:15

- Basel IV implementation: Overview of global progress and main challenges

- EU Banking Package 2021: Finalisation of the CRR 3 and CRD 6 legislative process

- Progress in other key jurisdictions: Focus on the new US Basel III endgame and UK Basel 3.1 proposals

- Expected impact across regions: Will Basel IV disadvantage EU banks versus their US or global counterparts?

Bozena Gulija

Financial regulation and risk management expert

Former Croatian National Bank and European Court of Auditors

Bozena Gulija is a financial sector professional with primary expertise in banking regulation and risk management, whose experience spans the private and public sector across several jurisdictions (EU, Netherlands, Belgium, Germany, Luxembourg and Croatia). She has worked for private companies including ABN AMRO, Euroclear, State Street, Nordea, and Intesa Sanpaolo Group, and public institutions such as the European Court of Auditors, the Croatian National Bank, and the Institute for International Relations. Bozena has been actively collaborating with several professional and academic institutions through lectures and research projects (e.g. Warwick University, Zagreb University, IADI-BIS, Central Banking, Risk.net) and as an author and reviewer (e.g. Financial Regulation International, IFLR - International Financial Law Journal, Journal of Banking Regulation).

Linkedin: https://www.linkedin.com/in/bozenagulija

15:15 – 15:45

Networking break

15:30 - 16:00

15:45 – 16:45

Advanced analytics: new methods and applications for macroeconomic policy

15:45 - 16:45

-

Big data and data science

-

Big data and central banks

-

Opportunities & risks

-

Applications to systemic risk

Stefano Borgioli is a Senior Team Lead - Economist-Statistician in the Monetary & Economic Statistics Division of the Directorate General Statistics of the European Central Bank (ECB). He joined the ECB in April 1999 after 3-year working experience as an economist in the Macro-Prudential Department of Banca d’Italia. He had temporary stints in both the Directorate General Macroprudential Policy & Financial Stability and the Directorate General Economics of the ECB.

He has worked extensively on banking statistics, statistics for macroprudential analysis and financial integration. He published in these areas and he frequently gives lectures at Universities (Politecnico di Milano, University of Florence, University of Frankurt).

Expanding the financial stability toolkit

13:00 – 14:00

Stress testing conceptual framework: Scenario analysis, stress testing and modelling approaches

13:00 - 14:00

-

Stress testing: taxonomy and key concepts

-

Stress testing in the euro area, UK, and the US

-

Stress testing: the way forward

-

Climate change stress tests

Pedro Duarte Neves is Adviser for the Board of Directors of Banco de Portugal. He was Vice-Governor of Banco de Portugal from June 2006 to September 2017. Pedro Duarte Neves participated at the main high-level supervisory and regulatory fora like the EBA, SSM, ESRB, and FSB. He was Alternate Chairperson of the EBA from July 2013 to June 2018 and he has chaired a number of committees in the scope of the FSB, EBA, and the Joint Committee of the ESAs. His research interests include banking supervision and regulation, macro-prudential policy, and the real economy.

Pedro Duarte Neves is a Visiting Professor at Católica Lisbon School of Business and Economics. He is also Associate at the Systemic Risk Centre, London School of Economics. Pedro Duarte Neves holds a PhD in Economics from Université Catholique de Louvain. He published in scientific journals like The Journal of Econometrics, Economics Letters and Economic Modelling.

14:00 – 14:15

Break

12:45 - 13:00

14:15 – 15:15

The systemic risks of shadow banking

14:15 - 15:15

Anand Sinha joined the Reserve Bank of India (RBI) in July 1976 and became deputy governor in January 2011. He was adviser in RBI up to April 2014 after demitting the office of deputy governor in RBI on January 18, 2014. As deputy governor, he was in charge of regulation of commercial banks, non-banking financial companies, urban cooperative banks and information technology, among others. He has represented the RBI in various Committees/Groups of the Bank for International Settlements (BIS), was on the G20 Working Group on Enhancing Sound Regulation & Strengthening Transparency and also a board member of the Securities and Exchange Board of India. He holds master’s degree in physics from the Indian Institute of Technology, New Delhi.

15:15 – 15:45

Networking break

15:30 - 16:00

15:45 – 16:45

Formulation of macro-prudential policies: implementation and governance issues

11:00 - 11:45

- Key steps for the effective design of macro-prudential policy

- Ensuring effective use of policy tools and instruments

- Main operational and governance challenges, institutional limitations and how to overcome them

- Discussion: formulation, implementation, and governance of macro-prudential policy in the delegates’ jurisdictions

Currently an international consultant in central banking and financial sector issues, Christian Durand was until 2018 deputy comptroller general of Banque de France, with direct reporting to the governor. His domain of responsibility included the audit function, operational risks and on-site inspections conducted by French examiners at the request of the Single Supervisory Mechanism (SSM) or the French banking supervision authority. Before that, he was deputy director general for economics and international affairs at the Banque de France, and in this context was a member of Banque de France Monetary and Financial Stability Policy Committees and regularly attended CGFS meetings at the BIS. During his career, Mr. Durand has held senior positions with the International Monetary Fund’s Monetary and Capital Markets Department, the French Banking Supervisory Authority and the French Securities and Futures Commission and led negotiations ending with the signing of MOUs with the US Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC). He has also worked extensively with financial institutions in France and other organizations, including the New York Federal Reserve Bank, the International Organization of Securities Commissions (IOSCO), FIRST initiative and the AFRITAC project. Through his different assignments he has developed a professional experience in central banking, international economics, financial supervision and financial sector development and stability issues. He has conducted or supervised the implementation of several technical assistance projects for the EU, the IMF or the Banque de France and led, for the IMF FSAP program, financial stability assessment missions in a wide range of countries starting with Cameroon in 1999 and ending with the United States in 2010. His academic education is in economics (thesis on “the concept of money in the controversies on capital, interest and fluctuations in the early thirties”), finance and law.

13:00 – 14:00

Measuring and Assessing Financial Stability by International Financial Institutions

13:00 - 14:00

-

A comprehensive approach to financial stability

-

Conceptual underpinnings of Financial Sector Assessment Program (FSAP)

-

Case studies

Daniel C. Hardy is currently a Senior Research Associate at the Vienna Institute for International Economic Research, and a consultant on economic policy issues. He spent many years at the International Monetary Fund, leading work on macroeconomic and financial sector surveillance; Fund-supported programs; Fund policies; and technical assistance in a wide range of industrialized, emerging market, and developing countries. Most recently he was head of the Debt Capital Markets Division and led numerous FSAPs. He has also held positions at the Deutsche Bundesbank and the Austrian Financial Market Authority, and been an academic visitor at St. Antony’s College, Oxford, and the Vienna University of Economics and Business. His recent research has addressed topics in public sector governance; the functioning of the European Monetary Union and the Capital Market Union; and sovereign debt management. He studied at the universities of Oxford and Princeton.

14:00 – 14:15

Break

12:45 - 13:00

14:15 – 15:15

Sovereign risk and macro stability aspects of debt management for EMDCs

14:15 - 15:15

Daniel C. Hardy is currently a Senior Research Associate at the Vienna Institute for International Economic Research, and a consultant on economic policy issues. He spent many years at the International Monetary Fund, leading work on macroeconomic and financial sector surveillance; Fund-supported programs; Fund policies; and technical assistance in a wide range of industrialized, emerging market, and developing countries. Most recently he was head of the Debt Capital Markets Division and led numerous FSAPs. He has also held positions at the Deutsche Bundesbank and the Austrian Financial Market Authority, and been an academic visitor at St. Antony’s College, Oxford, and the Vienna University of Economics and Business. His recent research has addressed topics in public sector governance; the functioning of the European Monetary Union and the Capital Market Union; and sovereign debt management. He studied at the universities of Oxford and Princeton.

Learning outcomes

•At the conclusion of the training, participants will be able to:

- Understand the macroprudential implications of a new world of rising inflation and interest rates

- Identify opportunities to improve the coordination and calibration of macro-prudential policy

- Understand the implications of Defi and Open Finance for financial stability

- Create scenario analysis for climate-related financial risks

- Identify potential new financial vulnerabilities

Chair

Maria Nieto

London School of Economics

Visiting senior fellow

María J. Nieto (PhD) is a Visiting Senior Fellow at the London School of Economics (Grantham Research Institute), Member of EBI and former Senior Advisor at Bank of Spain. She is author of numerous peer-reviewed articles (Journal of Banking and Finance, Journal of Financial Stability, Journal of International Financial Markets, Institutions and Money among others). She has cooperated as advisor with the International Monetary Fund and the Federal Reserve Bank of Atlanta for over 10 years and she serves on the advisory boards of the Journal of Financial Regulation and Compliance, the Journal of Financial Regulation, the Central Banking Training Advisory Board (UK) and the Institute of International Monetary Economics (UK). She has a PhD from University Complutense de Madrid, an MBA in finance from the University of California, Los Angeles (UCLA), and is a Certified Public Accountant (CPA)