Sponsorship opportunities

Sponsorship opportunities

Central Banking Meetings brings together key central banks and services providers to discuss issues affecting the industry to find solutions and improve efficiency. Becoming a partner of the Central Banking Meetings enables you and your organisation to join the conversation and share your insights on the pressing topics that are front of mind in the central banking industry. Our solutions offer the opportunity for thought leadership and brand recognition with the community.

Four reasons why partner with Central Banking Meetings

Meet the central banking community in person

Position your organisation as a thought leader

Reach senior central bankers and key decision-makers

Access the network of Central Banking's subscribers before, during and after the event

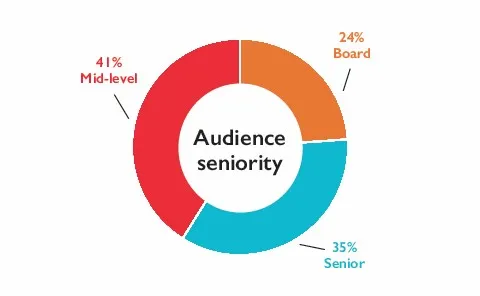

Our audience

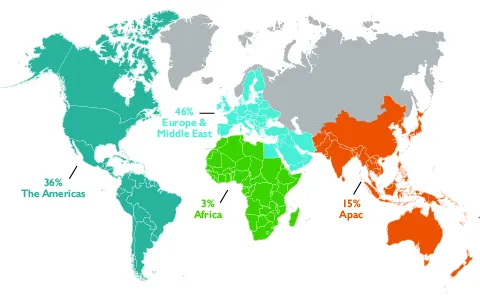

Global audience

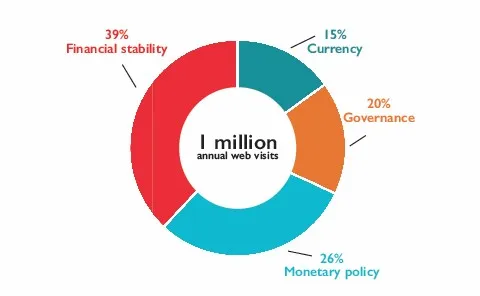

Most read topics on Centralbanking.com

100% central banking representatives

Connect with 147 Central Banks

2024 partners

Invesco is an independent investment management firm that helps clients build long-term, strategic partnerships with official institutions, offering the best of its investment expertise and capabilities.

It manages $1.4 trillion in assets on behalf of clients worldwide and offers specialised investment teams across a comprehensive range of asset classes, investment styles and geographies.

Invesco has more than 8,400 employees worldwide and an on-the-ground presence in more than 20 countries, serving clients in more than 120 countries.

About BNP Paribas Asset Management

BNP Paribas Asset Management (‘BNPP AM’) is the investment arm of BNP Paribas, a leading banking group in Europe with international reach. BNPP AM aims to generate long-term sustainable returns for its clients, based on a sustainability-driven approach. BNPP AM’s investment capabilities are focused around six key strategies: High Conviction Strategies, Liquidity Solutions, Emerging Markets, Multi-Assets, Systematic, Quantitative & Index and Private Assets, with investment processes incorporating quantitative and fundamental analysis.

Sustainability is core to BNPP AM’s strategy and investment philosophy. Among the leaders in thematic investment in Europe1, BNPP AM intends to contribute to a successful Energy transition, healthy Ecosystems, and greater Equality in our societies (our “3Es”). BNPP AM currently manages EUR 540 billion of assets (EUR 656 billion of assets under management and advisory) and benefits from the expertise of more than 500 investment professionals and around 400 client servicing specialists, serving individual, corporate and institutional clients in 67 countries.

Source: BNPP AM, as at 31 December 2023

1 Source: 2nd in Europe for active sustainable thematic strategies, according to an analysis made by BNP Paribas Asset Management based on Morningstar data as at 31/12/2022.

CAIM is a UK-regulated specialist investment manager with a particular focus on managing foreign exchange reserves on behalf of central banks globally. We offer directly managed bespoke strategies to each of our institutional clients, in public market fixed income and equities, across developed markets and China. We prioritize our clients, treat them as partners, and seek to become trusted advisors to each institution we work with. We can trace our roots back to 1749, when our predecessor organization was originally established by the British Crown. CAIM has via our predecessor organisation offered financial services to our clients since 1833. We began managing money for the world’s first sovereign wealth funds in the 1960s, and CAIM’s oldest current central bank reserves management account dates to the early 1980s.

Regnology is a leading technology firm on a mission to bring safety and stability to the financial markets. With an exclusive focus on regulatory reporting and more than 35,000 financial institutions, 70 regulators, international organizations, and tax authorities relying on our solutions to process their regulatory reporting data, we’re uniquely positioned to bring greater data quality, efficiency, and cost savings to all market participants. With over 900 employees in 16 offices and a unified data ingestion model powering our work, our clients can quickly implement and derive value from our solutions and easily keep pace with ongoing regulatory changes. Regnology was formed in 2021 when BearingPoint RegTech, a former business unit of BearingPoint Group, joined forces with Vizor Software, a global leader in regulatory and supervisory technology. The company is on a continued organic and external growth path, building up as one of the world's most recognized global regulatory reporting powerhouses.

SecurEyes is a specialized consulting and solution engineering firm focused in risk management, supervisory technology, regulatory technology and cybersecurity advisory services.

With 700+ global customers and 12,500+ consulting engagements, we are the trusted partner of several regulatory bodies, governments, and multinationals across the globe. We have obtained prestigious empanelment’s with reputable entities, as well as numerous prominent certifications.

Our state-of-art product SE-RegTrac is an enterprise supervisory product to digitize supervisory activities for central banks. It integrates supervisory and regulatory technology into a single platform thereby empowering regulators in risk-based supervisory responsibilities and at the same time equipping regulated entities in managing their regulatory responsibilities. It supports multiple sectors including banking, fintech, credit bureau, financing & leasing and insurance companies.

SecurEyes has demonstrated leadership in acquiring global recognition in many areas such as winning the “Technology Services Award 2023” by the Central Banking Awards Committee at the level of central banks worldwide for the year 2023.

Our other products help clients in regulatory compliance management, cyber supply chain risk management and operational risk management.

For detailed information, please visit: www.secureyes.net.

If you wish to contact a member from the SecurEyes team - please contact at riskmanagement@secureyes.net.

Company Description: Trade Data Monitor (TDM) publishes the official import/export trade statistics for 120+ reporting countries for every physical good being traded. The data is available in value, quantity, and average unit value (AUV). The database is updated every day and has the most recent revisions in the industry, so that our clients have the most recent information available. Clients use the data to analyze supply chains, investigate the economic health of each country and the world, identify new export market opportunities or mitigate risk, forecast market trends, and analyze global trade policy and how world events (i.e. climate change, war, global illnesses, labor issues) may impact trade flows.

Foreign Exchange (FX) and cross-border payments are often complex and expensive, especially when operating in hard-to-reach markets.

FIS is the world's largest global provider dedicated to financial technology solutions. FIS empowers the financial world with software, services, consulting and outsourcing solutions focused on retail and institutional banking, payments, asset and wealth management, risk and compliance, trade enablement, transaction processing and record-keeping. FIS’ more than 53,000 worldwide employees are passionate about moving their clients’ businesses forward.

BRED is a cooperative Banque Populaire, a member of BPCE Group, supported by more than 200,000 members, with €6.7bn in shareholders’ equity, and 6,300 employees – including 30% outside France and in the French Overseas Collectivities. It operates in the Greater Paris region, Normandy and in the French Overseas Departments, as well as in Southeast Asia, the South Pacific, the Horn of Africa, Switzerland and Dubai, via its commercial banking subsidiaries.

As a community bank with strong ties in local areas, it has a network of 475 business sites in France. It maintains a long-term relationship with 1.3 million customers.

BRED Banque Populaire operates in various activity sectors: retail banking, corporate banking for large-cap companies and institutional investors, wealth management, international banking, trading, asset management, insurance, international trade financing.

In 2023, BRED reported consolidated NBI of €1.34bn and net income of €319m.

Participating in the Autumn Meetings organized by Central Banking was an enriching experience. The dedication of the team, coupled with the diverse and insightful discussions, as well as central banking representatives, made it a valuable event for both speakers and attendees

Director of the Governor’s Office, National Bank of Angola

Central Banking Meetings is appropriate for dealing with today's problems

National Bank of Slovakia

The Central Banking Meetings are a valuable resource and excellent platform for learning, benchmarking, sharing ideas and networking with subject matter experts

African Bank

I found the wealth of knowledge gained from the various presentations and the different view points of the panelists very valuable

Bank of Jamaica

It was great to connect with people that share our interests and hopefully establish professional relationships, which will be very useful

Czech National Bank

The topics of discussion were very insightful, and [offered insight into] what other central bank reserves managers do – be it, strategies, risk management or governance structures. Networking opportunities for future collaborations were also a highlight

African Bank

The Central Banking Meetings offered a perspective of what [practices are] being followed in other jurisdictions, the issues they face and how they are tackling them

Reserve Bank of India

The Central Banking Autumn Meeting was nothing short of amazing. There were representatives from various central banks across the world and the content was rich. The panellists provided real-life experiences on CBDCs and on Cybersecurity and even if you attended with little knowledge, you left much better equipped to guide your own organizations. The networking and cocktails were simply the icing

Assistant manager, Information and Cybersecurity, The Central Bank of Trinidad and Tobago

Contact us